Carbon capture, utilisation and storage in Australia: If not now, when?

Australia has committed to a Paris-aligned 43 percent emissions reduction target by 2030, yet we remain a major exporter of fossil fuels and key supplier to carbon intensive hard-to-abate industries such as steel and liquified natural gas (LNG).

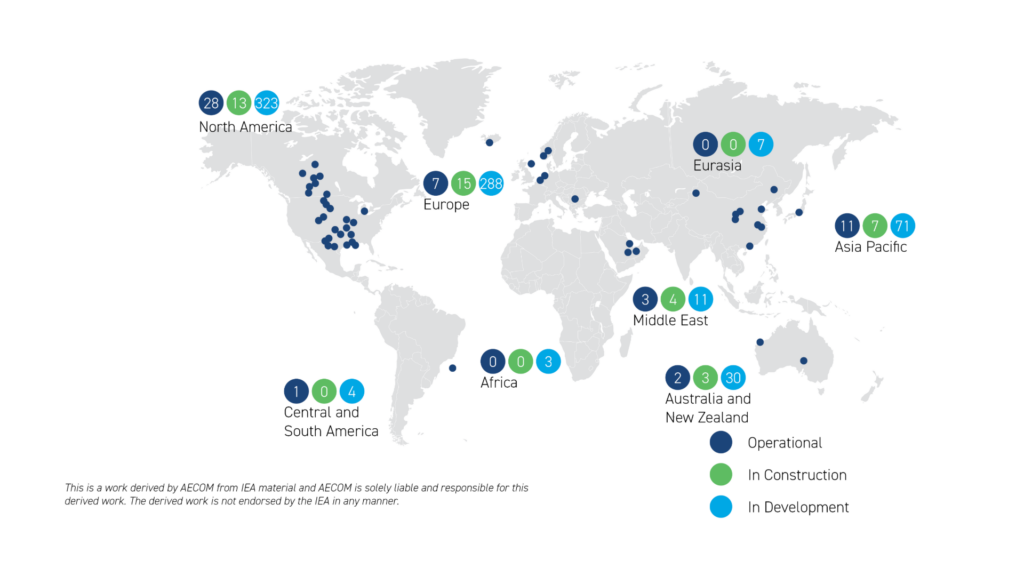

While global peers have accelerated investment in carbon capture, utilisation and storage (CCUS), Australia is falling behind despite our comparative advantage and opportunity to lead.

As global demand shifts toward low-carbon value chains, Australia has a rare opportunity to leverage its traditional resource exports, not only to lay the foundation for a competitive CCUS industry, but also to enhance our value proposition across both existing commodities and emerging low-carbon supply chains. Is this another example of the lucky country not taking advantage of its full opportunity?

As the world grapples with the urgent need to reduce greenhouse gas emissions, Australia stands at a pivotal moment in its journey towards a meaningful contribution to a Paris–aligned global net-zero outcome. AECOM’s recent study commissioned by Infrastructure SA (ISA) highlights the critical role CCUS can play in achieving net-zero emissions and how South Australia has the key ingredients to make it happen.

With a more aggressive nationally determined contributions (NDCs) due ahead of COP30 in Brazil, and in the race to host COP 31, Australia is under growing pressure to step up its decarbonisation commitments beyond the current 43 percent by 2030.

The recent 2023 Net Zero Australia study found there is almost no reality where we can reach net zero emissions by 2050 as a nation without developing our CCUS industry.

This is because it is one of the only technologies able to decarbonise certain hard-to-abate sectors, such as cement manufacturing, iron and steel production, chemicals, fertilisers and explosives, including their natural gas feedstock inputs.

Speaking of gas, the rhetoric has changed, and I think it’s safe (relatively, but I’ll hold my breath) to say it’s embedded as a key requirement in an orderly transition. These are also some of the most important sectors for our economy.

Is CCUS a perfect solution?

Let’s be clear: CCUS hasn’t always had the best reputation, and in many cases, that criticism hasn’t been without merit. Projects like Gorgon CCS in Western Australia, which failed to meet its injection targets and had major delays, cast doubt on Australia’s ability to build and commercially operate these facilities despite it capturing and storing over 10 million tonnes of CO2 to date. Not an insignificant amount when you compare this to 2023/2024 year to September national reported emissions of 434.9Mt CO2-e.

The reality is CCUS is not a silver bullet solution to decarbonisation. It should be considered as one of many complex pieces of the puzzle we need to effectively decarbonise, particularly for hard-to-abate sectors.

In South Australia, Santos has demonstrated its 1.7 Mtpa CCS ‘pilot’ plant ramping up to nameplate capacity with a Memorandum of Understanding signed, with various international off-takers for a 20 Mtpa plant expansion.

How does CCUS work?

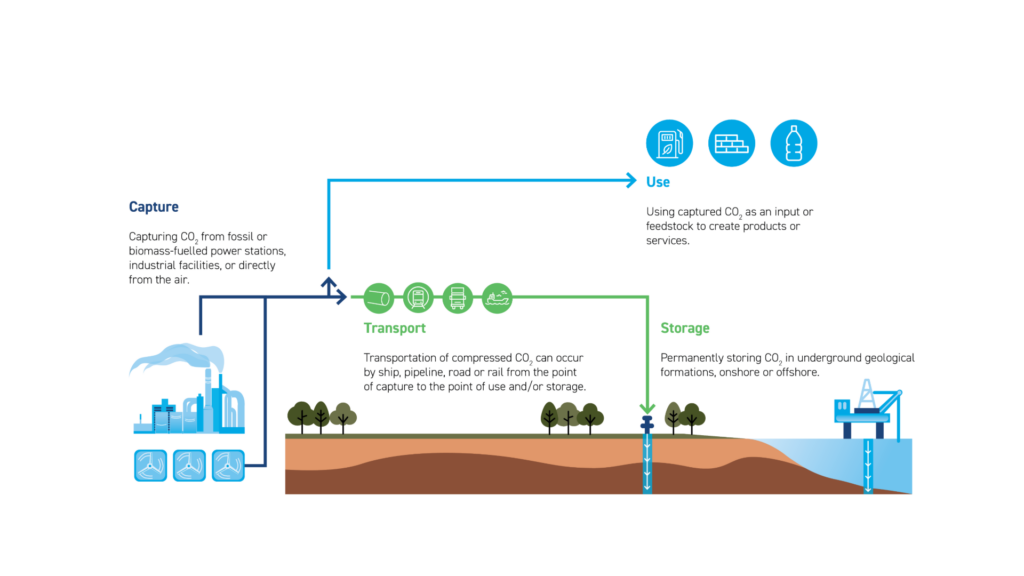

CCUS is the process of capturing carbon (in the form of CO₂) and either permanently storing it using geological formations (commonly depleted oil/gas fields or saline aquifers) or transforming it so it can be used in various applications (cue the U in CCUS).

To simplify the flow, the premise of the technology is to intercept and capture CO₂ that would otherwise be expelled into the atmosphere, compress it into a supercritical fluid (flows like a gas but dense like a liquid), transport it, and redirect it to ‘permanent’ storage or for productive re-use.

CCUS can also be a form of negative emission technology (NET) where carbon dioxide is directly captured from the atmosphere, hence the technology term for this application ‘direct air capture’ or DAC as it’s commonly referred. While economically challenged today, major offtakes and investment from major tech companies such as Microsoft and Amazon will no doubt steepen the learning rate and lower the technology cost over time. Let’s not forget nature based solutions (NbS) either, with growing interest in applications such as mineral carbonation of certain tailings as an example.

The ‘U’se case is broad, such as directly into food, beverage and agriculture industries or indirectly, for applications such as e-fuel production.

How would CCUS work in South Australia?

We studied how a CCUS infrastructure and supply chain could work in South Australia. We found a key competitive advantage for CCUS in South Australia both in its geology and experience workforce.

Depleted oil and gas reserves typically sit at a much greater depth and thus carry an advantage for how the molecule behaves in its supercritical phase. They also have proven geological seals that have safely contained hydrocarbons for millions of years, making them highly reliable for long-term CO₂ storage. When we look to the Cooper basin, there are also significant pre-existing gas pipelines and associated infrastructure corridors in place, which may be leveraged for its transportation.

So, what does a successful CCUS supply chain look like?

What does this look like in practice for South Australia as a global player?

- Natural gas extracted from the Cooper Basin has its process emissions captured by the Moomba CCS plant.

- Let’s assume electricity supply for the Moomba operation is also decarbonised, with abundant and coincident renewable energy.

- This gas is then sold to global trade partners, like Japan, which is the largest global importer of LNG, that have ambitious net-zero targets including aggressively transitioning coal fired power generation to gas coupled with CCS.

- The CO2 from gas-fired power generation is captured and shipped back to Moomba where it is safely stored in its place of origin (being a depleted oil and gas reservoir that has hosted the original hydrocarbon molecules safely for millions of years).

In practice, this is an innovative example of a true circular economy.

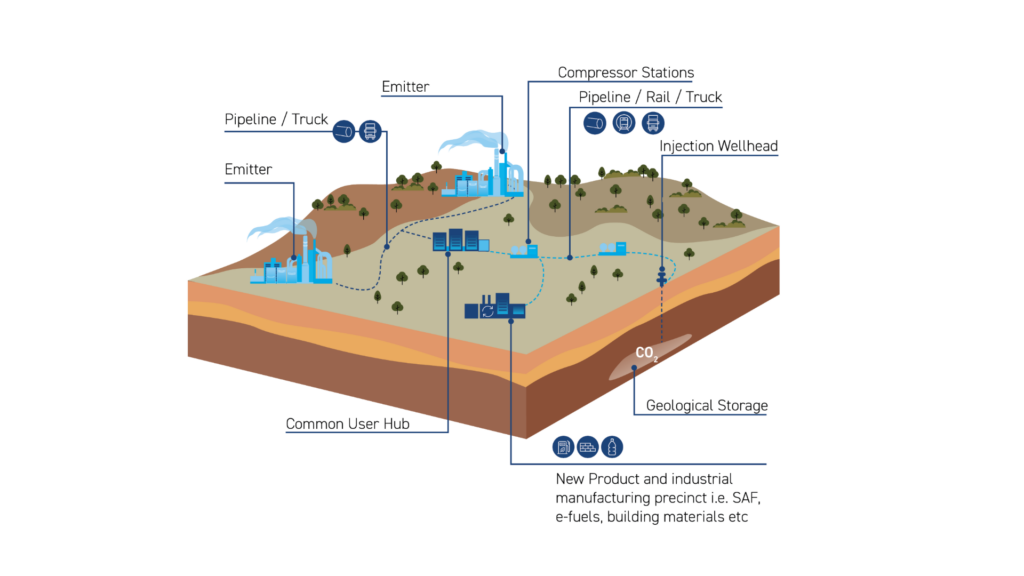

The physical infrastructure proposed by AECOM as required for a carbon capture supply chain would centre around a ‘common user hub’, a model gaining much favour across state and federal government for its many benefits.

CCUS hubs worldwide operate under various ownership and procurement models, shaped by policy, funding structures and efficient risk allocation. The main models include:

- Public-private partnerships (PPP): Where governments and industry share costs and risks.

- Industry-led consortia: With multiple members collaborating on shared infrastructure.

- Government-owned, industry-operated: Where there is public control with private expertise.

- Private sector-led with government incentives: Which is driven by policy incentives or tax credits.

- Build-own-operate (BOO): Where a single entity manages the full value chain.

The hub model aggregates the individual carbon emitters to a single location where costs for conditioning and compressing the gas suitable for transport can be shared. The hub model reduces risk due to operational standardisation, and incentivises hard-to-abate operators as it helps lower costs (which are shared between emitters) and allows for opportunity to scale as additional emitters come online.

The hubs could be set up near already functioning industrial clusters that collectively generate significant carbon emissions. In South Australia, we identified this within the Upper Spencer Gulf, a key regional area highlighted in the Net Zero Economy Authority priorities. Not only does it have a significant integrated steel industry, but it also has the right infrastructure to support global and national import infrastructure for a CCUS supply chain. The industrial hub model also supports job attraction and contributes to the growth of the local economy.

Could this model be applied to the rest of Australia?

While we recommend that the first phase of a functioning CCUS supply chain begins with the Upper Spencer Gulf industrial common user hub in South Australia, we identified two other clusters in New South Wales and Queensland that have solid fundamental conditions to use the hub model.

These are regional communities impacted by the energy transition where we’ve seen a steady decline in their original industrial industries – perhaps CCUS could also play a role in regenerating local employment?

Read Infrastructure SA’s CCUS infrastructure and national supply chain study, prepared by AECOM.