Germany at the heart of European property investment

The phenomenon that is the German property investment market continues to grow unabated despite the economic pressures that are being felt more widely across the Eurozone.

With a lack of available product and hence liquidity in the important ‘core’ and ‘core-plus’ asset types in all the major seven German economic centres, non-domestic investors are especially struggling to find an edge over key local players. Local networks, know-how and a nimble approach to deal making is allowing domestic investors to continue in their portfolio-building efforts, especially non-traditional asset types and in less popular locations. The more difficult the deal, the less interested the non-German investors are.

Prices are hardening across the board, be that portfolio-type deals, stand-alone sale-and-leaseback opportunities, or more traditional product. This is certainly no surprise in the perfect storm that is a surplus of equity, inexpensive and freely available debt finance, and a scarcity of product.

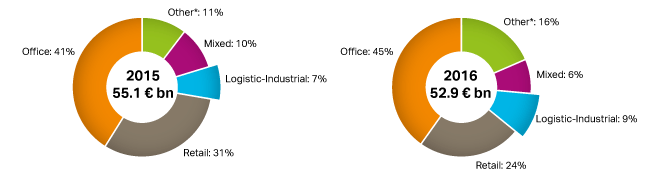

Property Transaction Volume in Germany by Type of Use

* Hotels, Land, Special Properties

With office and retail asset transactions continuing to maintain their popularity, hotel investment deals are also becoming more prevalent, primarily due to their defensive, cash generative characteristics. The German commercial investment market recorded transactions valued at €32.4 billion in the first nine months of 2016, with 4-star hotels leading the way as investments with a transaction volume of over €1bn in the first six months. Logistics transactions continue to grow at an impressive rate, primarily due to the increasing importance of e-commerce positively impacting this asset class from traditional larger regional hub properties, to smaller low-bay type product perhaps incorporating cross-docking. The logistics market is under inherent pressure due to its increasing popularity, coupled with ferocious investor appetite. New-build product is particularly hard to come by in the most popular hub locations, leading to investors becoming more and more involved with new developments earlier in the risk curve.

With significant recent expansion by the likes of Amazon and DB Schenker, Germany’s recent economic migration offers fresh opportunities for lower-skilled workers in a market where Amazon alone employs in excess of ten thousand workers and continues to grow. Recent reports indicate over €3.2bn in investments in the German industrial and logistics markets in the first three quarters of 2016, with anticipated record-breaking year-end total investments. According to an assessment by the German Logistic Association (Bundesvereinigung Logistik), logistics will play a central role in the integration and employment of Germany’s new demographic, playing a key sociological role as well as fueling country-wide economic development, not just in real estate.

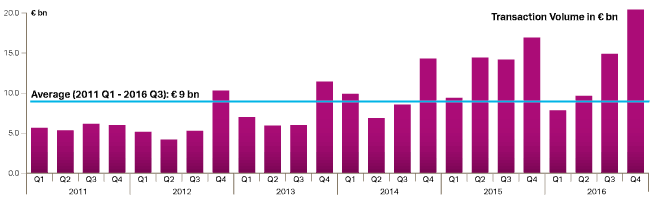

Property Transaction Volume in Germany

Six years of consecutive growth (2010-2016) and an unusually strong final spurt at the end of 2016 (involving numerous large individual and portfolio transactions)

At a practical level, the idea that the minimum wage is too high is seen as being of little relevance – both by the companies who say they are willing to embrace Germany’s new residents, as well as those who have no such plans. For the moment, there seems to be little barrier to the new supply of logistics product, but time will tell as to whether this new supply will lead to a softening in values, especially with secondary product, or whether the broader momentum and resilience of the German investment market will simply take this in its stride.

Looking ahead, it is difficult to find a report on Germany’s economy that does not mention the impact that the recent migration has had, and will continue to have on Germany’s strong, yet steady, economic growth. It seems universally agreed though, that economic growth is projected to remain solid, if unspectacular. A robust labour market and low oil prices continue to strengthen private consumption, while low interest rates and a continuing need for new housing continue to spur construction.

Germany has undoubtedly undergone significant change in recent years, however the fundamentals remain the same. As Germany evolves, it steadfastly remains at Europe’s economic heart, with property playing a key part in this continued prosperity.