A stronger outlook for construction in New Zealand

Sentiment for the infrastructure and buildings markets across New Zealand has bounced back from last year’s decline, with opportunities to address persistent challenges in housing, procurement, skills and materials shortages, and sustainability and resiliency, writes Craig Davidson, AECOM’s Managing Director ─ New Zealand.

This is the 10th year of the New Zealand Sentiment Survey, which canvasses not only opinion but also insights from across both clients and contractors into the forces shaping New Zealand’s infrastructure and buildings markets. We have had an unprecedented response from industry participants to this year’s survey.

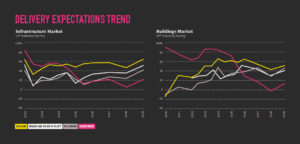

Highlights included an overall combined bounce in optimism and reduction in pessimism for both investment and delivery in the infrastructure and buildings markets, as well as an openness to consider creative solutions to perennial problems, including:

- traffic congestion in Auckland

- shortages of skills and building materials

- a national housing market that is expensive by international standards and in need of reform

- sustainability and resilience — with water reforms, earthquake strengthening and climate change important concerns

- financing/funding of infrastructure

- procurement issues

- smart investments to improve the economic performance of our country and its regions in the face of an uncertain global economic outlook.

An improving picture

There are a number of contributors to the overall positive results, ranging from the impact of spending resulting from the government’s NZ$3 billion Provincial Growth Fund, to continued inward migration to New Zealand, to efforts to unclog a booming Auckland with landmark infrastructure projects like the City Rail Link, among others. And while sentiment is strongest in Auckland, all regions are enjoying improved overall sentiment for both the infrastructure and buildings sectors, with some standout sectors like the so-called ‘3 waters’ of wastewater, potable water and stormwater showing significant improvements in sentiment.

Ongoing challenges

But there still remain some serious challenges plaguing the construction industry in New Zealand. It is no surprise, given that they are common challenges across the construction industry internationally, that skills and materials shortages were identified as the leading concern again this year, with funding in second place and then cost escalation and poor procurement practices (see Figure 1). And of course, New Zealand is competing with Australia and other countries for skilled labour, building materials and investment. Less commonly, New Zealand’s unusually short (three-year) electoral cycle was identified by many survey respondents as contributing to the overall difficulty of implementing necessary, but challenging, reforms in a number of areas.

A focus on solutions

This year’s Sentiment report includes articles outlining some potential solutions on infrastructure funding and financing from AECOM’s global CEO, Mike Burke, as well as others offering lessons from Australia and the United Kingdom to improve the approach to procurement in New Zealand, and a discussion of how introducing congestion pricing could benefit Auckland through improved traffic flow and productivity. It also discusses housing, big data and smart technology, local government, partnership and collaboration, as well as focussing a spotlight on each of the country’s five main regions: the upper, central and lower North Island; and the Canterbury region, and the rest of the South Island (see Figure 2).

In addition, the Sentiment Survey’s respondents provided many useful comments offering numerous potential solutions to problems, and highlighting challenges such as the adversarial nature of procurement. For example, they overwhelmingly felt that the typical procurement approach involved an overly burdensome and costly procurement process, and also that too much risk is being borne by contractors, so that a more-flexible and realistic apportionment of risk is urgently needed. They were also concerned that New Zealand was getting poor value for its spending on buildings and infrastructure due to a fixation on up-front costs of delivery, while turning a blind eye to ‘whole-of-life costs’ of a project that would usually be paid for out of a separate budget.

Securing funding and finance

Funding and financing infrastructure is a particular challenge in a small country that is far removed from the global centres of finance. Mike Burke’s article, which first appeared in AECOM’s 2019 Future of Infrastructure report, provides a wide range of strategies and solutions, ranging from asset recycling to value capture to greater direct investment in infrastructure by pension funds.

More-effective housing development

The importance of getting housing policy right cannot be overstated in a country suffering from a severe shortage of housing and respondents ranked nine key factors that could make housing delivery in Auckland more effective, with ‘increasing the quality of urban intensification’ and ‘fast-tracking housing consents’ ranking first and second. But housing is also negatively affected by skills and material shortages and fixing those, through making it easier to import building products from overseas, for example, could help to deliver houses for New Zealanders faster and cheaper.

With intelligent, considered reforms in a number of areas, from the water sector, to housing and sustainability policies, to measures to mitigate traffic congestion, our nation can improve our already-enviable quality of life for all.

This year’s report offers governments, clients, contractors, consultants and other engineering and construction professionals valuable insights and potential solutions to some of the thorniest problems the industry faces.

Download the report to find out more.