Increased performance commitments: how to prepare

Ofwat, the economic regulator of the water sector in England and Wales, has introduced a number of regulatory changes as part of its 2019 Price Review. Water expert Edward Day identifies four ways water companies will be affected and how they can best prepare.

To raise the quality of services water companies provide to their customers and both strengthen resilience and incentivise innovation across the industry, Ofwat has increased its performance expectations for water companies as part of its 2019 Price review (PR19) methodology.

The changes have been made ahead of AMP7, the water sector’s next asset management period, which runs from 2020 to 2025, and are expected to provide greater reputational and financial incentives for water companies to deliver better-value-for-money services to customers.

The changes are already driving step changes across the industry, putting water companies under pressure to optimise their investment decisions to improve performance for customers as the means of generating returns to their investors, rather than through financial levers such as beating the challenging 2.4 per cent cost of capital.

For many water companies, the changes are welcome and will help provide a positive profile for the sector at what is a politically delicate time. Some highlights of the changes include:

– An increase in common performance commitments from five to 14, which benchmark water companies and their ability to delivery key services to customers

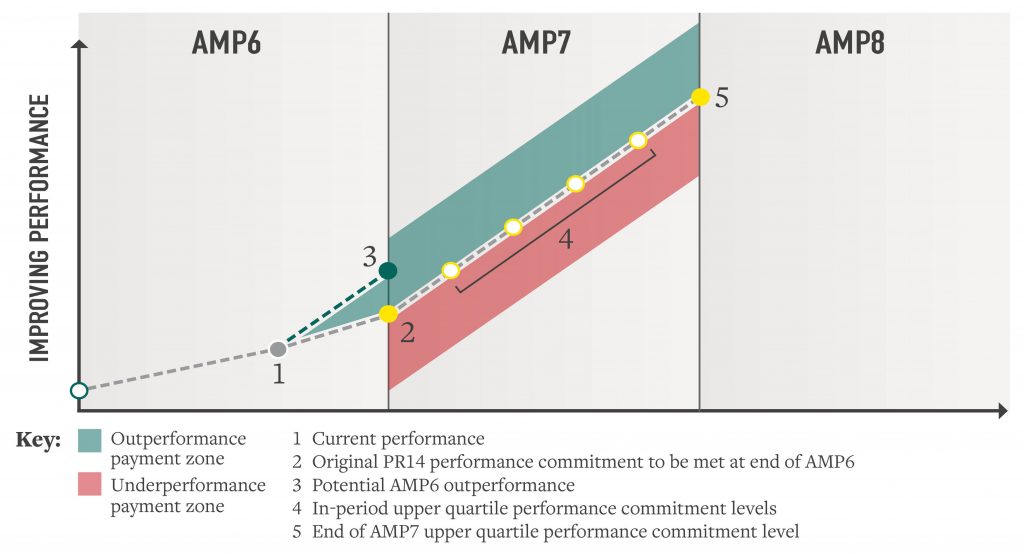

– A greater scale of outcome delivery incentive (ODI) outperformance and underperformance payments, placing water companies under greater pressure to outperform each other, so they can gain outperformance payments. Any company operating below the forecast ‘upper-quartile’ performance of the industry will be penalised from year one of AMP7

– Adoption of in-period ODIs, instead of an assessment at the end of each five-year AMP cycle.

Ultimately, the changes are likely to impact on water companies in a number of ways. We look at four key anticipated effects and suggest how water companies can best prepare for them.

Immediate increase in operational spend

The requirement to hit forecast ‘upper quartile’ industry performance targets each year from the first year of AMP7 (2020-21) means water companies who continue to target only their PR14 performance commitments would end up with significant penalties at the start of AMP7.

How to prepare: Increases in operational spending are likely to produce the most rapid short-term performance improvements. Water companies should start focusing on achieving AMP7 performance commitment levels that provide an optimal financial position, as well as those that will respond fastest to specific solutions, such as preventing future sewer blockages and flooding by putting extended sewer cleansing programmes in place. Ultimately, it is likely that water companies will need to invest more towards the end of AMP6 to avoid significant AMP7 underperformance payments. There is however an opportunity for companies to gain significant returns for their investors by outperforming their peers on common performance commitments.

The need to meet in-period upper quartile performance commitment levels means water companies will need to be even more certain that their investments are resulting in increased performance and provide the best value for money.

Enhanced performance-tracking

The previous five-yearly performance commitment assessment gave companies more time to fix any underperformance and in turn reduce their chances of being penalised. The switch to yearly ODI assessments means water companies will need to be even more certain that their investments are resulting in increased performance and provide the best value for money. It could be challenging for water companies to measure improvements that lead to increased performance across multiple commitments, and where improvements take time to show results, such as natural, social and human capital benefits.

How to prepare: Water companies should start tracking their investments against performance commitments more thoroughly to gain a better understanding of whether or not they are on their way to achieving their targets. Companies will need to start putting robust tracking procedures in place, such as checking actual benefits realised against expectations in original plans, as per the UKWIR Common Framework (2014), and reviewing their reports periodically, for example monthly or quarterly, to check performance levels, and to give themselves enough time to react and rethink underperforming investments to avoid penalties. Through economic analysis and by using specialist tools, we’re helping Yorkshire Water forecast the multiple, long-term benefits of its investments in financial, manufactured, natural, social, human and intellectual capital so it can make better-informed investment plans and decisions across the business.

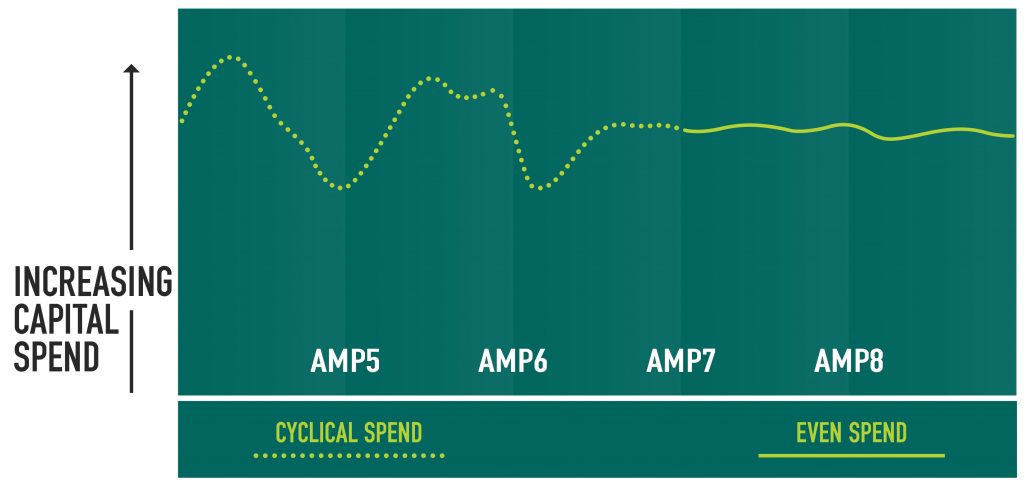

Even industry spend profile

Yearly ODI assessments are likely to encourage companies to spread their investment more evenly across AMP cycles, over and above the transition programme. The water industry’s typically cyclical nature could be reduced or removed, which could put an end to a common grievance among the industry that cyclical spending makes it harder to retain staff and associated ‘intellectual capital’, stifling innovation.

How to prepare: More even spending could give water companies more certainty when it comes to committing to investing in more innovative ways of gathering, analysing, acting on and communicating their performance information within their businesses and to clients and investors, for example. By investing in field operators to prioritise responses to customer queries through to senior management focusing programmes of work and reporting back to investors and regulators, water companies can ensure everyone is working together to drive innovation that will ultimately help water companies meet their enhanced performance commitments.

Rise in tender prices

By spending more at the end of AMP6, to meet upper quartile performance in the first year of AMP7, many contractors could face an unexpected squeeze on resources. Combined with work needing to be completed potentially faster than usual, contractor tender prices could rise significantly in the latter years of AMP6.

How to prepare: Water companies need to start working more closely with their alliancing partners and contractors to ensure they receive the best prices for increased work in AMP6. They should also analyse their procurement processes and directly procure their materials and subcontractors for their Tier 1 contractors using increased economies of scale and fixed framework contracts to mitigate cost changes due to the increased demand.