Surplus office space to cutting-edge laboratory: three refit considerations

The Life Science sector is growing and so is the demand for suitable research and development premises, presenting public sector bodies and commercial developers with a golden opportunity to repurpose existing assets into laboratory facilities. It’s fast, cost-effective and sustainable, says AECOM’s Alison Wring.

The UK’s Life Sciences sector is a national success story. It supports almost a quarter of million jobs and generates £70 billion in economic value, and it is growing – fast.

This growth is in part thanks to historic – and continued investment. In the Spring 2020 budget, the government announced a commitment to doubling the amount of funding to Life Sciences. The sector is also in the spotlight as numerous organisations, from global pharmaceutical companies, to the Department of Health, Public Health England, academia and science parks collaborate on a vaccine against coronavirus. These efforts have also been backed by government, which has pledged tens of millions of pounds to scale-up research, particularly among start-ups.

This combination of factors means that the demand for suitable research and development facilities is rising exponentially, as there was a shortfall of space even before the current pandemic. Whereas constructing newly built premises is slow and carbon intensive, refurbishing existing office space offers a faster and more efficient solution. It’s a golden opportunity for commercial developers and public sector bodies to re-evaluate their existing assets to meet that demand, one that has the potential to deliver higher rental returns.

In this article we examine Life Science sector needs and why it is good time to repurpose surplus sites. We also share three considerations that asset owners can make when examining real estate portfolios.

Understanding sector needs

So, what exactly is the Life Science sector looking for? For most the answer is location, location, location. As traditional science disciplines blend with tech and digital science, life science companies are increasingly seeking out premises in areas where Innovation Districts are either established or emerging.

According to laboratory fit-out specialists Galileo Labs, “The nature of life science research is shifting to a collaborative model where co-location and open and accessible facilities for smaller science companies is required. Combining the academics with clinical staff as well as research and development (R&D) partners creates a unique ecosystem, making property in the area extremely sought after.”

With continued investment in rail infrastructure, Cambridge and London connectivity is supporting the growth of these life science/healthcare ecosystems, alongside Oxford, with activity in the capital centred round the Knowledge Cluster at King’s Cross/Euston as well as Imperial College’s Innovation District at White City. Other key areas in the UK include Alderley Park near Manchester, Innovation Birmingham near Aston University, and Edinburgh’s BioQuarter. Across the water, Belfast and Dublin both have thriving Life Sciences clusters, particularly with the convergence of technology and life sciences .

The UK is still adjusting to new remote working practices in relation to coronavirus, but the sector is very limited in terms of what can be done outside the laboratory environment due to the need for sterile spaces and the increasing use of artificial intelligence to process vast data sets at speed. Demand is therefore growing for a range of accommodation from small labs for start-ups to larger combined laboratory and office space for more mature businesses.

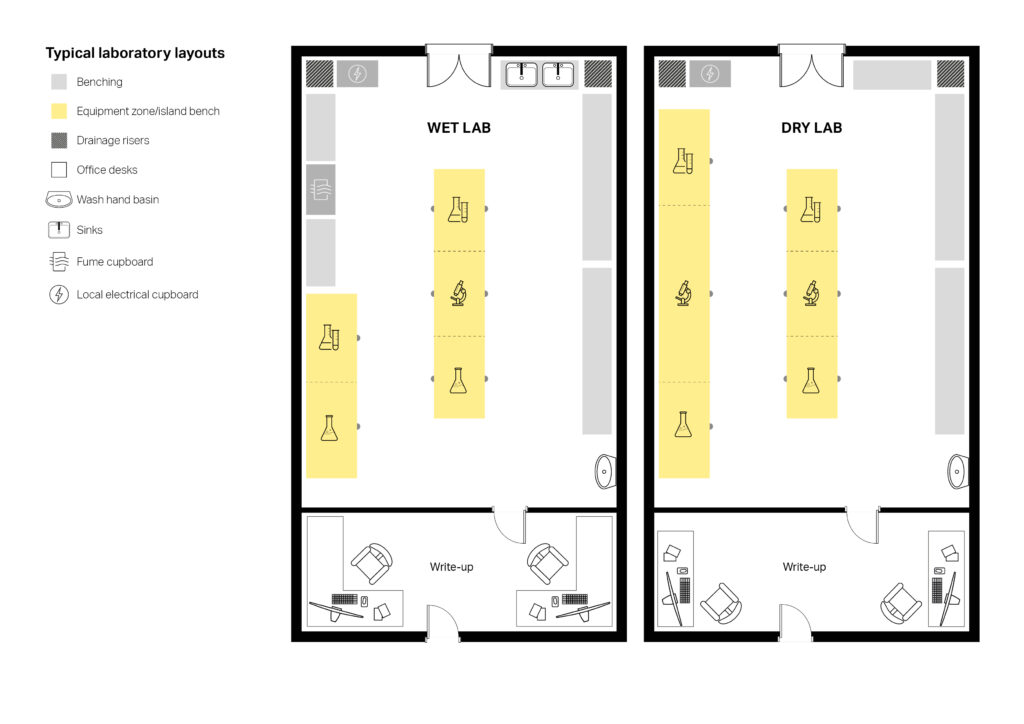

Crucially, life science companies are also moving more towards enhanced office environments with smaller areas of wet/dry lab content, as traditional analysis methods are being replaced by smart, advanced technology. This is good news for those looking to repurpose existing facilities because less floor space needs the structural and services modifications to accommodate wet/dry lab areas.

However, no matter what the size or type of accommodation, co-location remains a key draw.

Repurposing existing space can meet demand

The UK has significant unmet property demand for small and large purpose-built science space in key locations. Public sector organisations looking to improve or relocate well-located parts of their estates while at the same time disposing of more obsolete sites are in a strong position, particularly if they consider working with commercial partners.

Repurposing an existing office block (or other space) with the right design parameters for laboratory use is advantageous in many ways. The representative rental values in London for laboratory space can range between £70 – £125 per sq ft compared to those for office space which are £57.50 per sq ft, according to Galileo Labs.

From a sustainability perspective, refurbishment can deliver a 56 per cent reduction in carbon emissions compared to a new build facility – giving lab space strong eco-credentials that may be attractive to prospective tenants. Aside from sustainability, there are significant gains in terms of speed to market. In addition, refurbished space can be flexible enough to accommodate multi-tenant start-ups right up to more established operators, who may wish to rent entire floors.

Here East, formerly the Media Centre for the 2012 Olympics, is a good example of an innovation and technology campus for start-up companies. Granta Park, a science park in Cambridge, has also undertaken studies into repurposing its existing space.

Three considerations

Here are three considerations when refitting space to a laboratory environment:

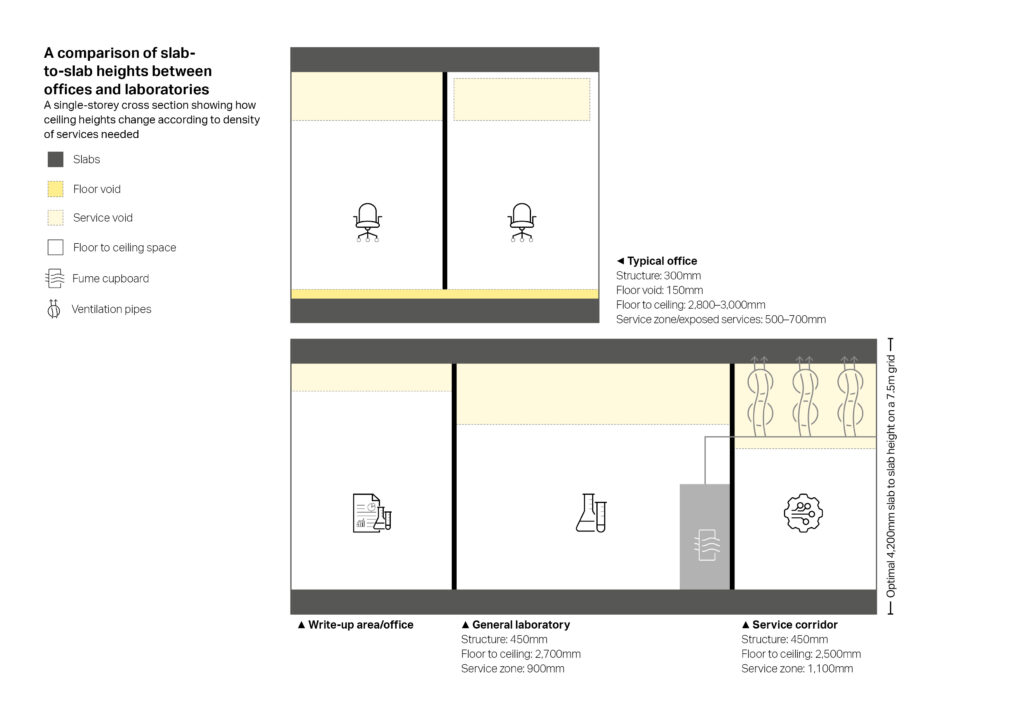

1/Consider slab heights and risers

An initial viability needs to quickly determine the slab-to-slab height of a building to establish whether there is enough height to bring in additional services, such as risers. Typically, a lab storey height would be 4.1 to 4.5m high (top of slab to soffit) allowing for the vertical distribution of air across the floor plate, compared to an office which is more likely to be 3.6m to 4.2m. Older properties such as telephone exchanges, banking halls and financial institutions generally lend themselves to this configuration, due to their dense frame and generous storey heights. Equally, warehouses, industrial premises and even shopping malls could be considered.

A solution to lower storey height buildings is to create greater density of internal risers and plant room space.

2/Take advantage of financial incentives

There are specific tax benefits associated with research and development (R&D). The capital cost of construction works to create dedicated research facilities for owner-occupiers benefits from 100 per cent capital allowances. Any innovative design or construction solutions to overcome site-specific scientific or technological uncertainties may qualify for R&D tax credits. These provide an enhanced (or super) deduction of 230 per cent for eligible staff costs for SMEs, or a 13 per cent ‘above the line credit’ for large companies.

3/Factor in wellbeing

Facilities with roof terraces and other recreational zones will be highly sought after, especially in urban areas. Scientists work in controlled environments so break out areas such as wellness/contemplation rooms and outside spaces will be in demand. These spaces can also be safely adaptable to serve a variety of functions in line with government distancing guidelines.

A golden opportunity

The case for refurbishment has never been stronger, and not just because it is a low carbon alternative to building new premises. It is also cost-effective and has the benefit of faster speed-to-market delivery, as well as being an opportunity to unlock assets in high-demand locations.

More space is clearly required to enable the life science sector to grow and refurbishing existing assets can help meet the demand for well-located, well-equipped laboratory space, while providing healthy returns.

The design and construction industry still has some way to go in communicating and demystifying the office-to-lab refurbishment process and increasing awareness amongst asset owners that they have a golden opportunity to maximise their underutilised or poorly performing assets. However, the case for office to laboratory refurbishment is strong and, as a result, we expect confidence amongst asset owners to grow.

With thanks to AECOM’s Josh John, Senior Project Surveyor and Lewis Peacock, Associate for their contributions to this article